HOW TO BECOME A FILER – COMPLETE GUIDE:

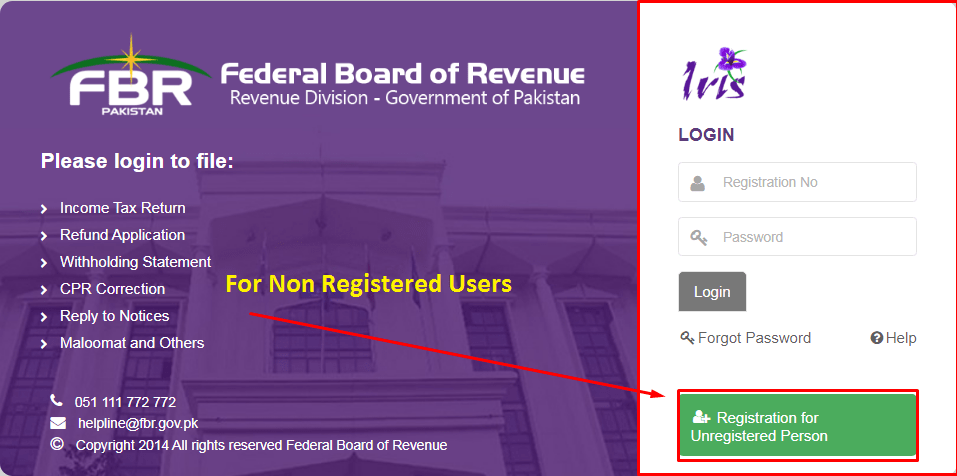

- Open the FBR IRIS portal, click on registration for an unregistered person, and give all relevant information.

- Open the IRIS portal again and click on e-enrolment from the different options.

- Enter all the details such as CNIC, and mobile number to complete the registration process.

- Login to your account and enter all your income details in the form. After completing this, you are a tax filer now.

- Type 13 digit CNIC number and send an SMS to 9966, to check whether you are on the active taxpayer list or not.

A comprehensive guide to NTN, checking ATL status and E-enrolment:

Pakistan has a low tax-to-GDP ratio compared to other emerging economies, averaging only 11 percent. Low tax revenues contribute to high fiscal deficits and constrain fiscal space for infrastructure and fiscal spending.

FBR statistics reveal only 1% of the population is on the Active Taxpayer/Filer list. A country afflicted with enormous external debt needs to drastically improve this ratio. Good governance is impossible without adequate state capacity to collect revenues. Digital technologies can enhance FBR’s capacity if its leadership focuses on broader accountability systems around technological deployment and structural changes. Big data and analytics are key considerations in this ongoing challenge as they offer smart but quick reforms with the ability to identify and thwart efforts to commit tax fraud and abuse in terms of recording the value of imported goods.

The government has introduced several measures to bring the increased population into the tax net and increase tax revenue to service external debt and invest in the country’s infrastructure. Measures ranging from less vehicle tax, withholding tax on every transaction more than Rs 50,000, and withholding tax on supplies and services are a few of the several factors initiated by the Government/FBR.

Additionally, owing to decreased revenue from direct taxes, the Government invariably resorts to indirect taxation such as federal sales tax, regional sales tax, and customs tariffs for higher collection. This causes inflationary pressure on the economy and enhances the gap between rich and poor.

GETTING NTN FROM FBR:

- Firstly, you have to open the FBR IRIS portal using the link below:

https://iris.fbr.gov.pk/public/txplogin.xhtml

- After that, click on registration for an unregistered person.

- Enter all details in the form which are asked of you such as CNIC number, name, address

- Two codes will be received from FBR through SMS and email

- Enter the codes in the relevant field

- Click on submit button and your account will be created

- FBR will send your username and password via email or SMS.

- After logging in, you will see 181 application form

- Enter your details such as CNIC, father’s name, and address for NTN Registration

- Once submitted, the NTN number will be received from FBR within a few hours

Documents required for NTN:

- Copy of valid CNIC.

- Copy of recently paid electricity bill of the house (not older than 3 months).

- Contact numbers and valid email addresses.

- NTN number of Employer, Office Address, and valid email address.

- For Business NTN, attach business letterhead and property or rental papers.

HOW TO BECOME A FILER/ENROLMENT OF A REGISTERED PERSON:

- When you are done registering yourself in the FBR system, then you have to open the IRIS portal again with the following link:

https://iris.fbr.gov.pk/public/txplogin.xhtml

- Click on e-enrolment for registered persons.

- A form will appear on the screen.

- Fill out all the information like CNIC number, name, cell number, and valid address.

- Click on submit button.

- When you complete this e-enrolment registration, you will receive a password from FBR via SMS or email.

- Enter the CNIC number in the Registration field and enter the password you received via SMS from FBR.

- After receiving the draft option, edit the form.

- Enter the relevant information in the Personal tab, Business tab, Property tab, Link tab, and Bank Account tab. Attach the relevant document.

- The information should be correct and should be from the current tax year.

- After clicking the submit button, the process ends.

How to check the Active Tax Payer list:

There are different ways to check whether you are on the active taxpayer list or not. There is a complete income tax available on FBR’s official website.

- Open the FBR website.

- Click on “ATL income tax”. After that, you will see an active taxpayer/Filer list for income tax which can be downloaded on a computer.

- Download the list and check your name.

Checking ATL status via SMS:

To check the status via SMS:

- Open your mobile phone message app

- Type ATL 13-digit NIC number and send it to 9966.

- In case of checking the ATL status of AOP or Company, type ATL 7 digits NIC and send it to 9966.

Checking ATL status via Online Portal:

To check the status via an online portal, follow the steps provided below:

- Open the following link in your browser

https://e.fbr.gov.pk/esbn/Service.aspx?PID=Dbue2kxCaiyqHHkwEvtwFA==

- Will see two blank fields of Registration No and date respectively.

- After that, enter your CNIC or NTN in the Registration no field.

- Type the date as well.

- There is a captcha code given below the blank field. Write the code as it is in and click on verify.

- After that, see the ATL status.